Table of Content

For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse's company may have health insurance coverage for the entire family; it would be wise to compare the offerings of each health insurance plan and choose the preferred plan. As an aside, unlike the federal government, states often tax municipal bond interest from securities issued outside a certain state, and many allow a full or partial exemption for pension income. To know the break-up of your gross salary, you can contact your employer or look through the monthly payslip.

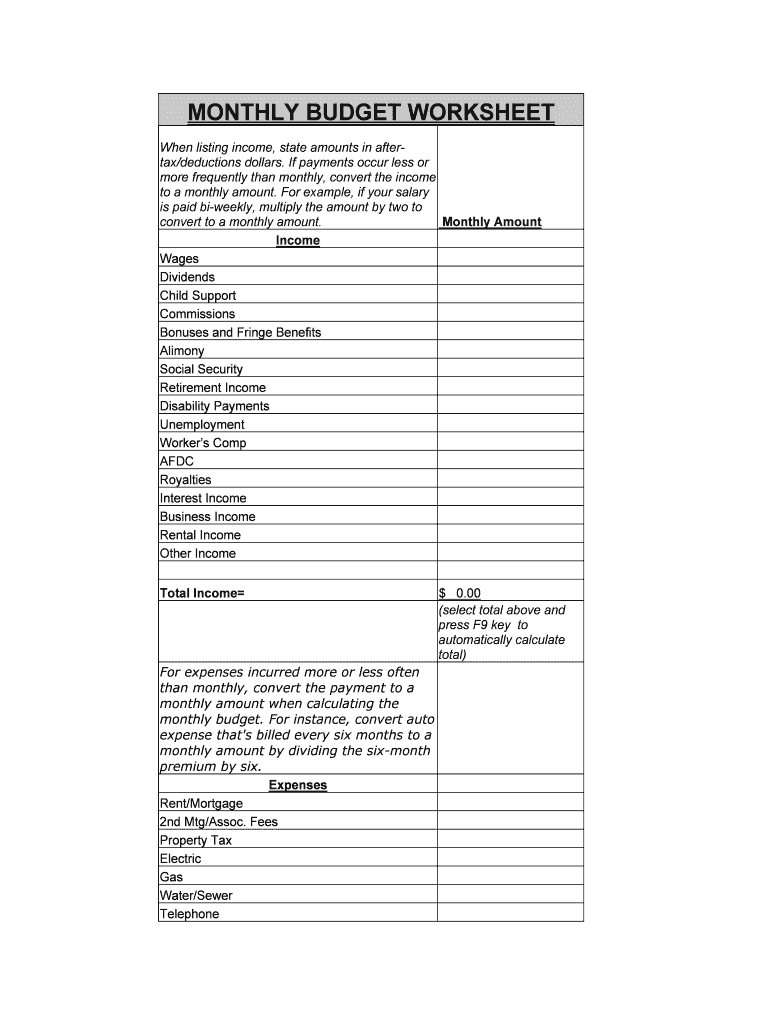

The standard deduction dollar amount is $12,950 for single households and $25,900 for married couples filing jointly for the tax year 2022. Taxpayers can choose either itemized deductions or the standard deduction, but usually choose whichever results in a higher deduction, and therefore lower tax payable. After all deductions such as provident funds and taxes have been made, the employee pays the total amount. In most cases, the net compensation is less than the gross income.

What do you mean by CTC?

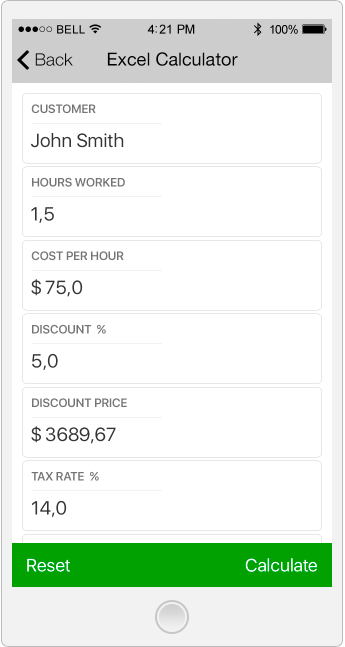

As most employers do not include bonus payments in the calculation of pension deductions, the calculator also makes no changes to pensions in a bonus period. During the Coronavirus outbreak, the government have said that they will subsidise employers' costs to pay staff who are not working and are instead placed on "furlough". The government subsidy is limited to 80% of the employee's salary, or £2,500 per month, whichever is the lower. To make sure this cap is applied to your calculations, tick the box. Enter the number of hours, and the rate at which you will get paid.

Check your securities/MF/bonds in the consolidated account statement issued by NSDL/CDSL every month. Needs to review the security of your connection before proceeding. Explore salaries and job trends across careers from every industry. If you’re after an example of exactly what to say in a meeting with your manager about a pay rise, you can use this script. Get a sense of industry standards for roles like yours so you go into salary discussions equipped with a realistic view of what you’re currently being paid and what to aim for.

Calculation for Salary

Independent contractors or self-employed individuals pay the full amount because they are both employees and employers. This is one of the reasons why independent contractors tend to be paid more hourly than regular employees for the same job. Federal income tax is usually the largest tax deduction from gross pay on a paycheck.

Deductions can lower a person's tax liability by lowering the total taxable income. Since salary calculations are often tedious, most people in India prefer the online take-home salary calculator. Fisdom’s take-home salary calculator is a free tool that can be used anytime.

Employer contributions

This bonus tax calculator determines the amount of withholding on bonuses and other special wage payouts. In our calculators, you can add deductions under “Voluntary Deductions” and select if it’s a fixed amount (pre-tax), a percentage of the gross-pay (pre-tax), or a percentage of the net pay (post-tax). For hourly calculators, you can also select a fixed amount per hour (pre-tax). You are tax-exempt when you do not meet the requirements for paying tax.

Be sure to double check all the stipulations before selecting, however. Picking the wrong filing status could cost you time and money. Traditionally in the U.S., vacation days were distinctly separate from holidays, sick leaves, and personal days. Today, it is more common to have them all integrated together into a system called paid time off . PTO provides a pool of days that an employee can use for personal leave, sick leave, or vacation days. Most importantly, the reasons for taking time off do not have to be distinguished.

Keep in mind that this is different from the median salary that we explored earlier; the median looks at the middle of a set of salaries, while the average calculates all salaries into a mean. Select your state from the list below to see its salary paycheck calculator. On 23rd September 2022 Chancellor Kwasi Kwarteng announced that the 1.25% increase in National Insurance contributions which took effect in April would be reversed. From 6th November 2022, the standard rate of NI will return to 12% and on earnings over the upper threshold will return to 2%. If you are married and were born before 6th April 1938, you receive a tax rebate. Tick the "Married" box to apply this rebate to calculations - otherwise leave the box clear.

Simply increasing relevant knowledge or expertise that pertains to a niche profession or industry can increase salary. This may involve staying up-to-date on current events within the niche by attending relevant conferences or spending leisure time reading on the subject. Location—Different locations will have different supplies and demands for positions, and average salaries in each area will reflect this. Keep in mind that the cost of living should be noted when comparing salaries. In some cases, a job that offers a higher salary may equate to less overall once the cost of living of a different location is accounted for.

If you're employed, then recall that federal taxes have already been taken out of your paychecks. Pay frequency refers to the frequency with which employers pay their employees. The pay frequency starts the entire payroll process and determines when you need to run payroll and withhold taxes. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal, state, and local W4 information into this free federal paycheck calculator.

A salary or wage is the payment from an employer to a worker for the time and works contributed. To protect workers, many countries enforce minimum wages set by either central or local governments. Also, unions may be formed in order to set standards in certain companies or industries. Federal income tax and FICA tax withholding are mandatory, so there’s no way around them unless your earnings are very low. However, they’re not the only factors that count when calculating your paycheck. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes.

In contrast to other parts of the CTC, the base wage would stay unchanged. Employers withhold federal income tax from their workers’ pay based on current tax rates and Form W-4, Employee Withholding Certificates. For those who do not use itemized deductions, a standard deduction can be used.

No comments:

Post a Comment